SiC is finally here!

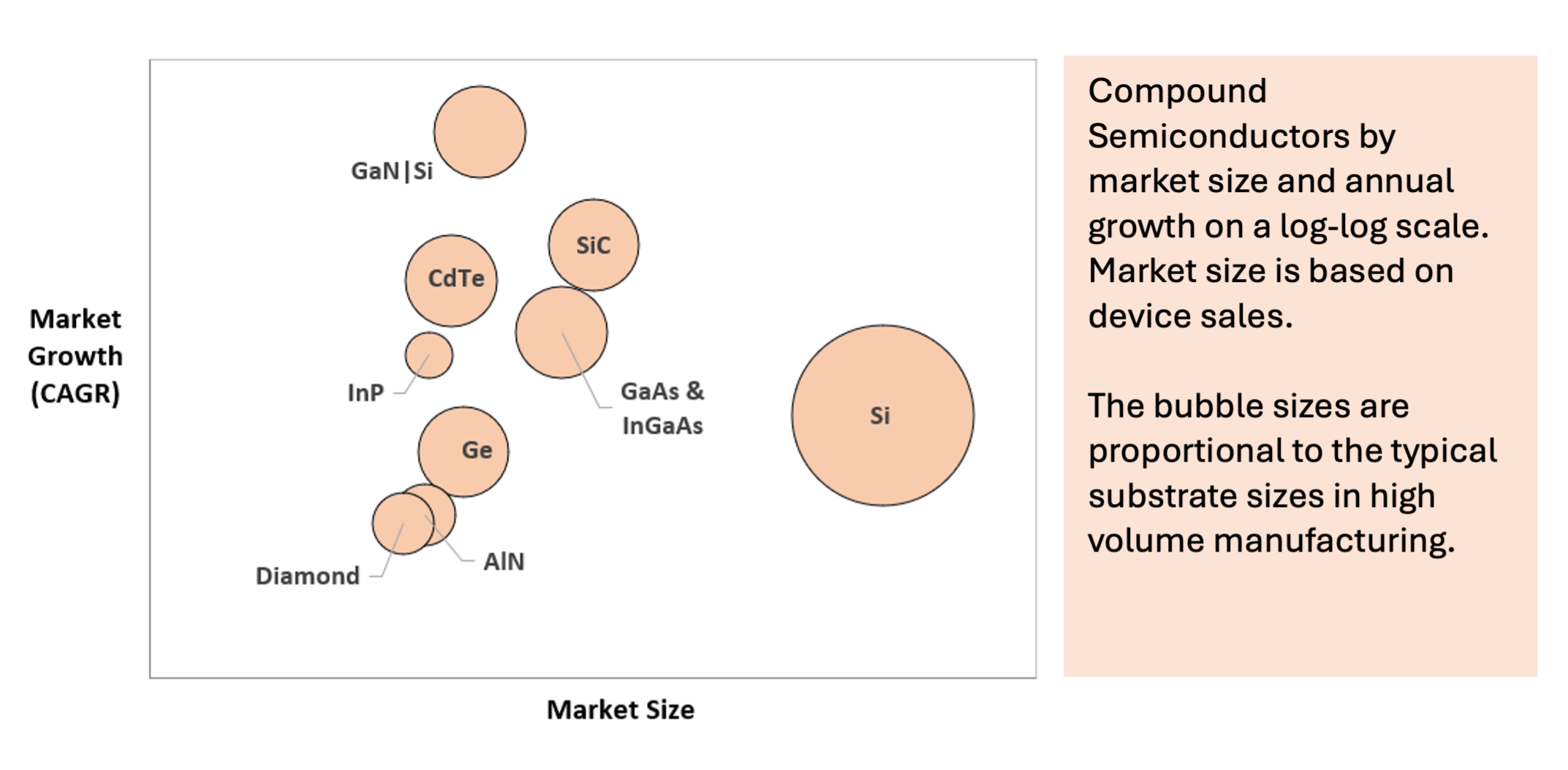

For decades, we got used to thinking that silicon was the only answer. While the world’s largest fabs were busy taping out Silicon, the Compound Semiconductor (CS) community continued pushing forward. Whether it’s InP, SiN, GaAs, Ge, InGaAs, CdTe, GaN, or SiC, the world of Semiconductors is a lot more than just silicon. With Tesla introducing Silicon Carbide (SiC) in its EV, the world learned SiC could no longer go unnoticed. This market has grown to over $2.5B in 2023 and is expected to continue growing at a staggering 24% CAGR, according to Yole. Today, the majority of players in EV electronics offer SiC power ICs.

This created a new ecosystem with material suppliers, capital equipment, fabless, foundry, and OSATs. Some players went fully vertically, starting with the SiC powder and ending with multi-die power modules. Those are the IDMs, including ST, onsemi, Wolfspeed, Infineon, Denso, Bosch, Rohm, SanAn, and more… Because of the high cost of the raw material, many new players got into the substrate business. Many invested heavily via M&A and organic growth and are now faced with the challenge of returning to the shareholders on the investments. In this fierce competition, many must be questioning their long-term strategy.

Benefits are costly

SiC offers excellent benefits to both designers and consumers. Thanks to the material properties, transistors in SiC can be operated at much higher voltages, with lower resistance, showing less performance degradation with temperature. These make the SiC electronics appealing for power conversion and charging applications in vehicles and power grid applications. However, the raw material is substantially more expensive than silicon. Crystal growth of SiC is orders of magnitude slower than silicon; its hardness, second only to diamond, makes it hard to slice, polish, and dice; high operating voltages require thick epitaxial layers that exhibit high defectivity; vertical transistor architecture requires substantial wafer backside processing. All those translate to higher defectivity, lower yield with frequent yield excursions. To the consumer, it’s higher product cost and lower reliability in the field. In the end, nobody likes getting stuck with your brand-new EV after leaving your life’s savings at the dealership.

Years behind Silicon

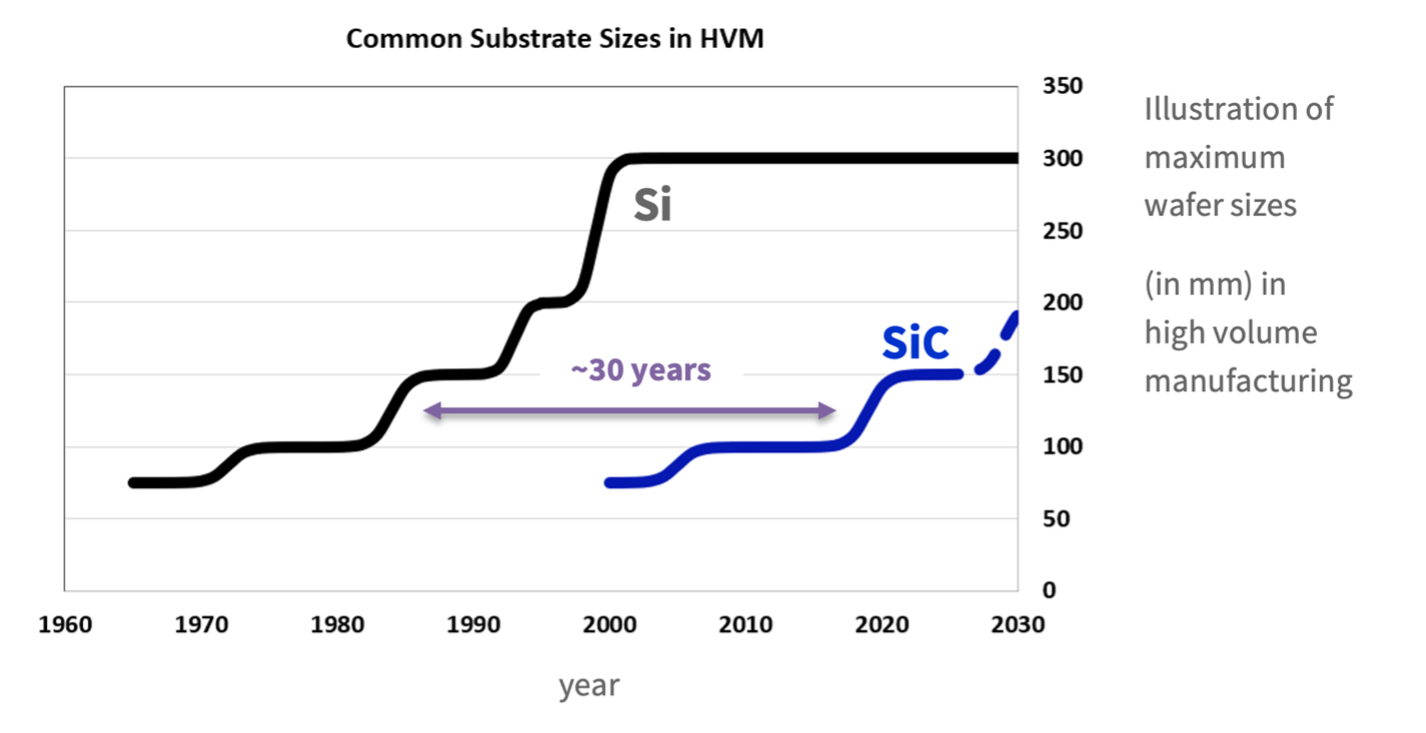

The common cliché among manufacturers is that SiC is decades behind silicon. The dominant wafer size is a good indication of material platform maturity. Historically, as silicon manufacturing matured, the industry transitioned to a larger wafer size, going through 100, 150, 200, and 300 mm wafers over the past four decades, as shown in the figure below.

At the same time, SiC is made today predominantly on 150 mm substrates. Meanwhile several companies announced a transition to 200 mm substrates. Recently, Chinese substrate supplier SICC demonstrated 300 mm substrate, however use of such a large substrate is far beyond the horizon. In the following several years, most of the capacity is expected to remain on 150 mm wafers. So yes, SiC is indeed 30 years behind silicon, judging by the substrate sizes in volume manufacturing.

Complexity of today’s circuits in SiC resembles Silicon chips in the eighties. The integration into complex circuits happens today at the package level rather than on a monolithic IC as seen in silicon. While the most complex Silicon ICs count billions of transistors, SiC ICs are nowhere near such complexity. The reason is simple – die yield scales exponentially with the die area. At high defectivity levels this becomes detrimental, and the only way is going with a smaller die, integrating known good die at the package level into a more complex circuit.

While SiC does seem decades behind silicon, it does not need to take decades for SiC to catch up.

The Big Data Platform

Methodologies developed over the decades in silicon IC manufacturing are now available. An example of this is our Exensio™ platform, built on 20 years of experience deploying data analytics for Silicon. Here, we turn our attention to the data and how it is utilized efficiently to streamline innovation. After all, playing in this field for decades gives us some clues.

- Breaking the silos: the technology cycle from IC design to high volume manufacturing is painfully long, has many players involved and many data silos across operations. That’s where end-to-end big data platforms come into play – to connect all data end-to-end and make it available to a broad range of functions.

- Smart factory: Today’s front-end factories are quite different from their predecessors from decades ago. Today’s manufacturing ecosystem offers a variety of software capabilities from dozens of suppliers with well-established interoperability.

- Standardization: Thanks to several organizations (e.g., SEMI, GSA, SIA), there is a broad landscape of industry standards covering everything from equipment connectivity to data formats and specifications. Standards enable better interoperability between tools and suppliers, streamlining equipment and software deployments to support yield ramp.

- Material Traceability: whether you are tracing wafers in a fab or die in an assembly line, you are up to a complex task. Multiple substrate IDs, rework at several steps, substrate grading, and cherry-picking are just a few examples. In an assembly line, it’s no smaller challenge. Luckily, many of those issues have been solved with traceability standards.

- Data Model is where the rubber meets the road. Now that you have your incoming material data, inline data from the fabs, assembly, and test data from the OSATs – how do you use it to accelerate learning and ramp? Data Model describes the physical entities (equipment, wafers, dies, modules), processes (fab, assembly, test), and their relationships in the context of manufacturing flow.

- AI/ML: Decades ago, scientists had to scramble and develop analytical relationships between causes and effects, software development folks would come up with SW specifications, and so on. Nowadays, a myriad of data-centric frameworks and the ubiquity of AI/ML shorten this cycle, eliminating numerous bottlenecks. Whether you are an “ok Google” or a “hey Siri” person, you do not want to rely on a team of data scientists any time you have a question.

- Too much data: vast amounts of data are generated per wafer throughout the manufacturing operations. However, the majority of that data is never used. At the same time, customers in the automotive segment are putting more stringent requirements on their chip and module suppliers regarding data retention. That’s where the data platform must enable a good mix of storage options allowing trade-offs between performance and cost and provide the knobs for data caching and aging.

- Of course, none of the items above are rocket science. Any manufacturer can get there with their home-grown solutions. While the initial cost of these solutions seems low, they are hard to maintain long-term and often end up more costly in human capital. Adopting industry-standard solution allows the manufacturers improve efficiency and ramp the yields faster than the competition. And that’s the reason we are seeing more companies knocking on our door.

What’s next

According to Yole, TrendForce, McKinsey, and SEMI, growth is forecasted for most compound semiconductor devices. Silicon Carbide is definitely at the top of that list. Following Gartner’s terminology of the “hype cycle,” it is past the trough of disillusionment. Both silicon and GaN have been carving out more space in the Power IC market. This change will push SiC for performance and cost. At the same time, more players are stepping into the market in each of the segments – material suppliers, foundries, fabless, and IDMs. Competition will intensify, pushing manufacturers for higher yields, faster development cycles, and higher levels of integration. Under the pressure for cost and performance, designers and manufacturers must start adopting the industry-standard Big Data Platforms. In the following posts, we’ll cover the various aspects of such a platform.

To learn more, click the links below:

References:

- What does the future hold for the semiconductor industry? Aug 2024

- Power SiC and GaN maintain their growth trajectories toward nearly $10B and above $2B, respectively, in 2029 despite the headwind from the global economy in the short term. Yole, Sep 2024

- SiC Power Device Market (2024 Edition) R&M, June 2024

- Power SiC – Manufacturing 2024 Yole, Apr 2024

- 2024 Global GaN Power Device Market Analysis Report TrendForce, Aug 2024